Insightful. Intelligent. Transformative.

Sagility is a U.S.-based, tech-enabled healthcare business process management company that supports payers, providers, and their partners to deliver best-in-class operations, enhance the member and provider experience, improve the quality of care and promote health equity all while delivering cost effective healthcare financial and clinical outcomes.

Why Sagility

With more than two decades of experience, Sagility manages extensive payer and provider operations, engagement services, clinical services and healthcare financial services with efficiency and scale. Our dedicated experts solve complex healthcare challenges with deep domain expertise and innovative thinking. Sagility’s technology, processes, and solutions ensure efficient operations and avoidance of additional administrative costs beyond labor arbitrage. The high level of trust and satisfaction with the quality of our work has earned us an “Excellent” Net Promoter Score of 56 in our annual CSAT survey.

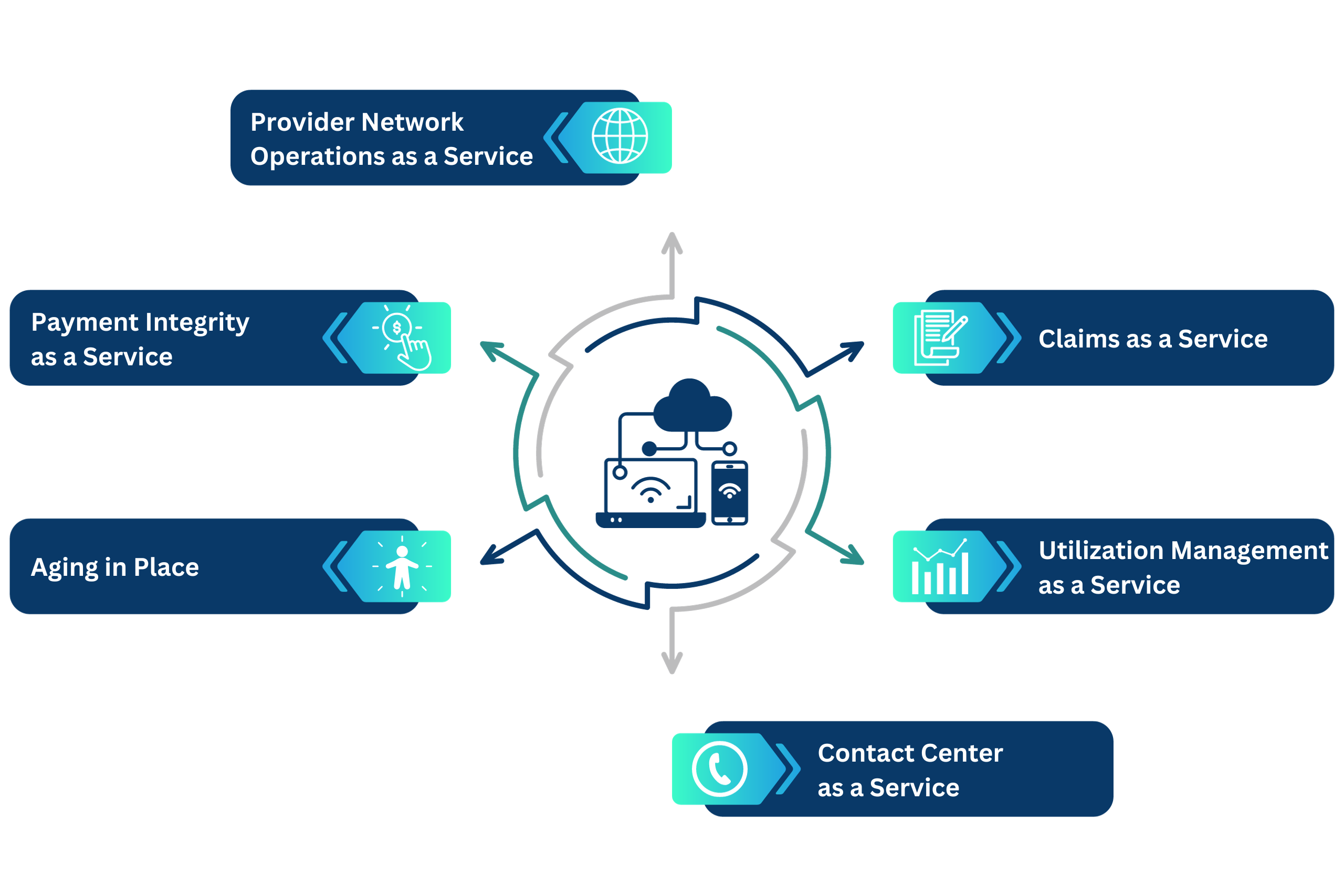

Our BPaaS Offerings

We combine technology and deep domain expertise to position our end-to-end Business Process as a Service (BPaaS) solutions within the payer’s existing ecosystem. Our holistic, cloud-based approach spans claim operations, engagement services, provider network operations, clinical solutions and payment integrity services. We can help increase your productivity, enhance predictability of spend, and improve healthcare processes while allowing you to focus on the business’ priorities.

Learn MoreSpeak with an expert to hear more

Connect with a Sagility expert today. Let’s explore innovative solutions tailored to your organization’s unique needs.